Margin

Margin

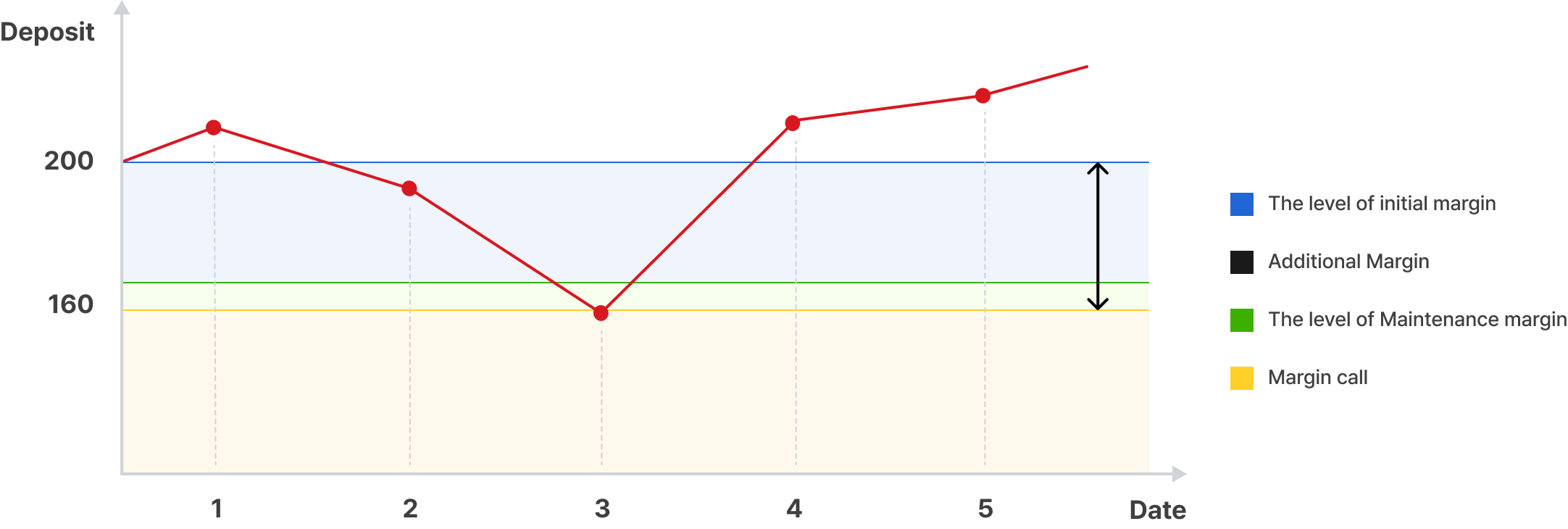

Futures and options are high-risk and high-return products. Because of its high-risk, it is necessary to retain collateral as a customer's guarantee to fulfill his/her settlement obligations. A customer is required to deposit and maintain with the member firm the initial margin, which varies depending on the settlement risk presented by the open positions held.

A member is not allowed to place an order without the sufficient margin requirements. For the transaction between KRX and members, members do not have to deposit the Exchange margins with the KRX before trading. However, customers are required to make the necessary deposit by 10 a.m. of T+1 day.

Deposition of Margins

Customer may deposit cash, cash-equivalent securities(substitute securities) or foreign currencies as margin.

Margin Call